Welcome to our archived blog page. This page includes advice and our thoughts through 2022. Please see the Prato Perspective page on our website for our most current articles.

Is the Fed Right?

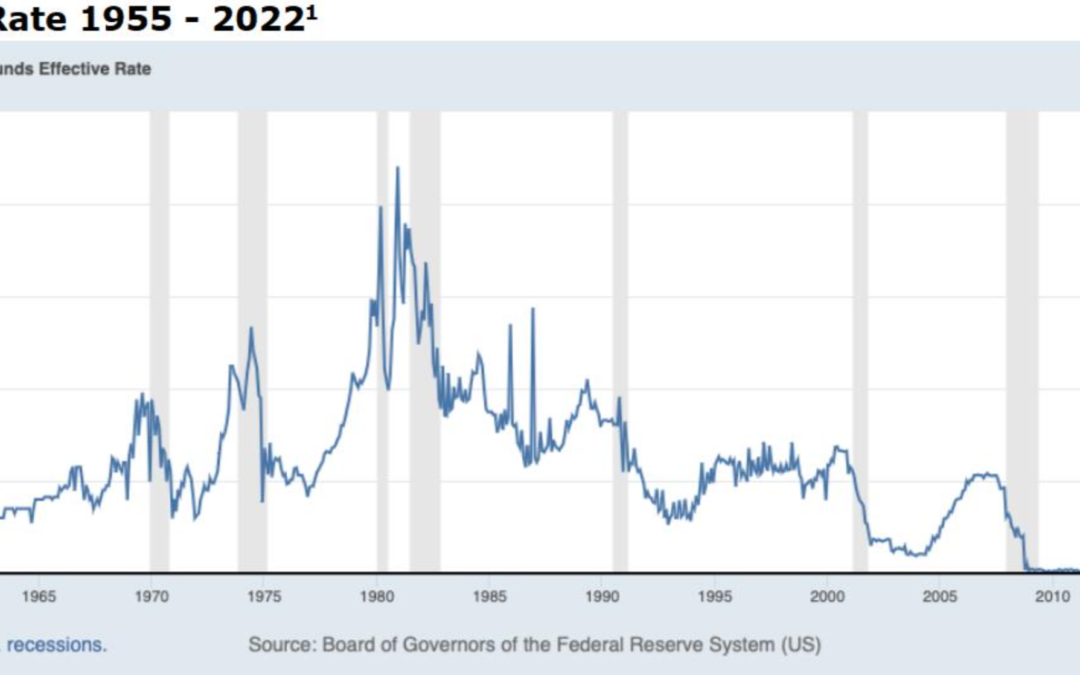

Since the start of this year, many commentators and analysts have been asking this very question – Is the Fed getting it right? They continue with more questions: Are interest rates being raised too fast? When will rates decrease? Will high interest rates drive the...

What is PCM doing with Fixed Income?

November 18, 2022 Over the past few months, we have discussed how the markets have been driven by news of inflation and interest rates. Many of our recent conversations with clients have revolved around these topics and specifically the fixed-income portion of their...

What’s Behind the CPI?

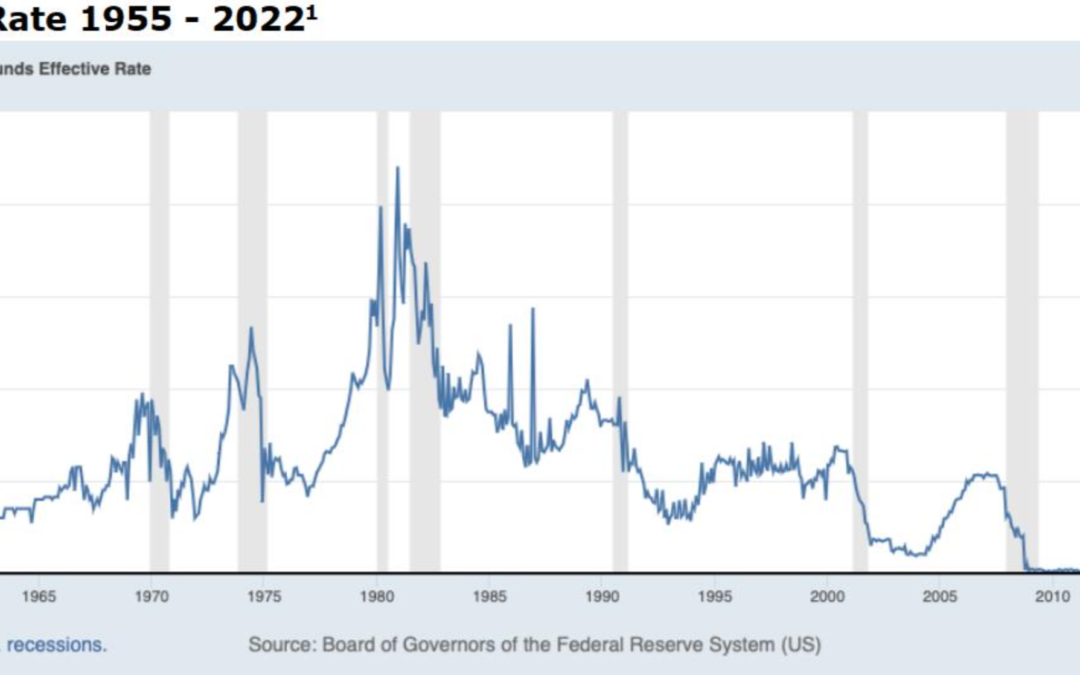

October 20, 2022 The Consumer Price Index The Consumer Price Index (CPI) is defined as “a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.”1 The US Bureau of Labor Statistics releases the...

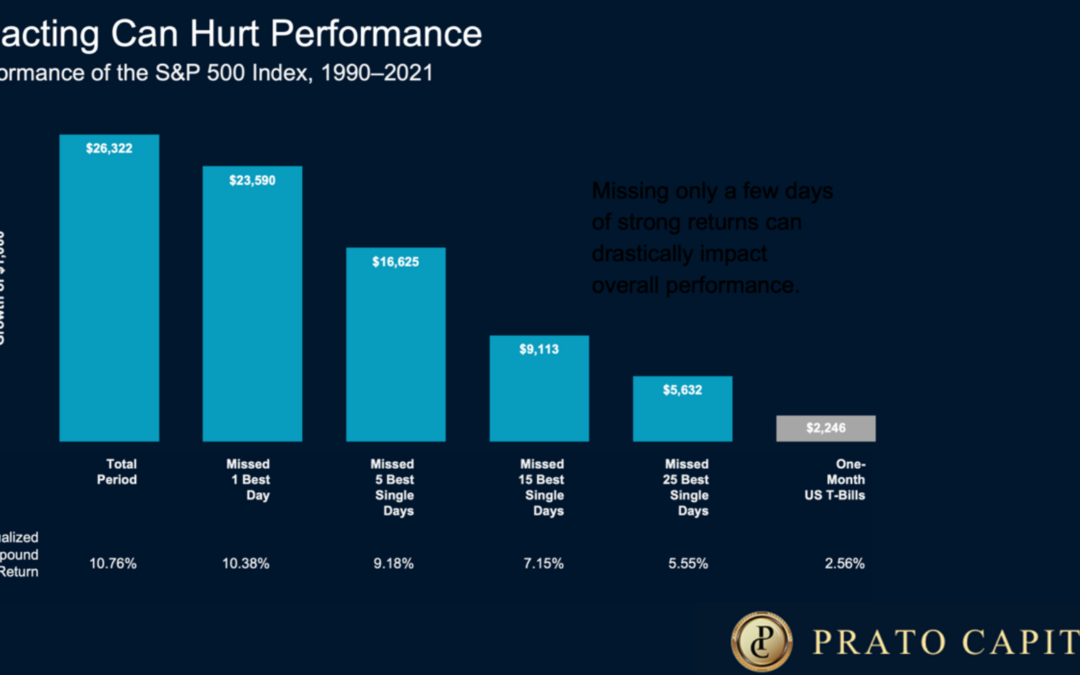

Which involves more risk

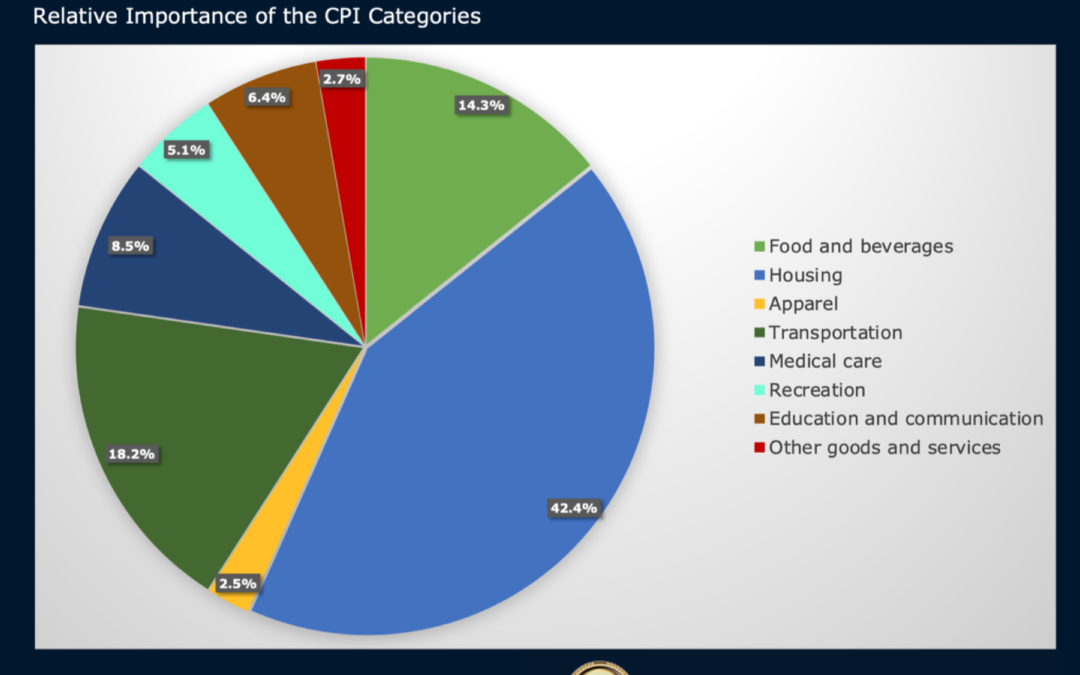

September 23, 2022 For many investors, the volatility we have seen over the past few weeks has many considering if it is time to sell their stocks and move to cash. A Portfolio During Volatility During periods of volatility like we are seeing now, timing the markets...

The Impact of the Federal Reserve on the Stock Markets.

At an economic policy symposium in Jackson Hole, Wyoming, Federal Reserve Chair Jerome Powell said, “Price stability is the responsibility of the Federal Reserve and serves as the bedrock of our economy. Without price stability, the economy does not work for anyone....

Is the 60/40 portfolio Dead?

August 16, 2022 A portfolio of 60% stocks and 40% bonds has been used for decades now as a reliable way for many long-term investors to capture much of the gains of stocks with less volatility overall due to the bonds held in the portfolio. With both stocks and bonds...

With all of the negative headlines dominating the news today, what should investors do?

July 14, 2022 With all of the negative headlines dominating the news today, what should investors do? Here are some questions that many clients may have and answers that may help during the volatile market periods like we see today: What does a possible recession mean...

If it sounds too good to be true …..

At Prato Capital, we receive lots of emails from investment firms looking for our business, meaning they want us to invest our client’s hard-earned savings with them. And recently many of these emails have highlighted their short-term returns that have outperformed...

Bear Market, Rising Interest Rates, and Recession Chatter

It has been quite the week in the economic and investment fields. The mainstream news and business programs have devoted a lot of airtime to this week’s news of the S&P 500 entering a bear market¹, the Federal Reserve raising the benchmark interest rate by 0.75%...

Declines in April and Continued Market Volatility

May 5, 2022 April Declines News headlines described the April returns of the S&P 500 as “the worst April returns in 30 years.” Although that may be correct, in the past 30 years, we have seen months with greater declines greater than April 2022. And let’s not...