July 14, 2022

With all of the negative headlines dominating the news today, what should investors do?

Here are some questions that many clients may have and answers that may help during the volatile market periods like we see today:

- What does a possible recession mean for my portfolio?

As we have seen during the recessions of 2007-2009 and in 2020, stocks normally recover before the economy recovers. Our June 2020 Newsletter discusses previous recessions and stock market returns during those times. - Should I sell the stocks or funds in my portfolio to prevent further losses?

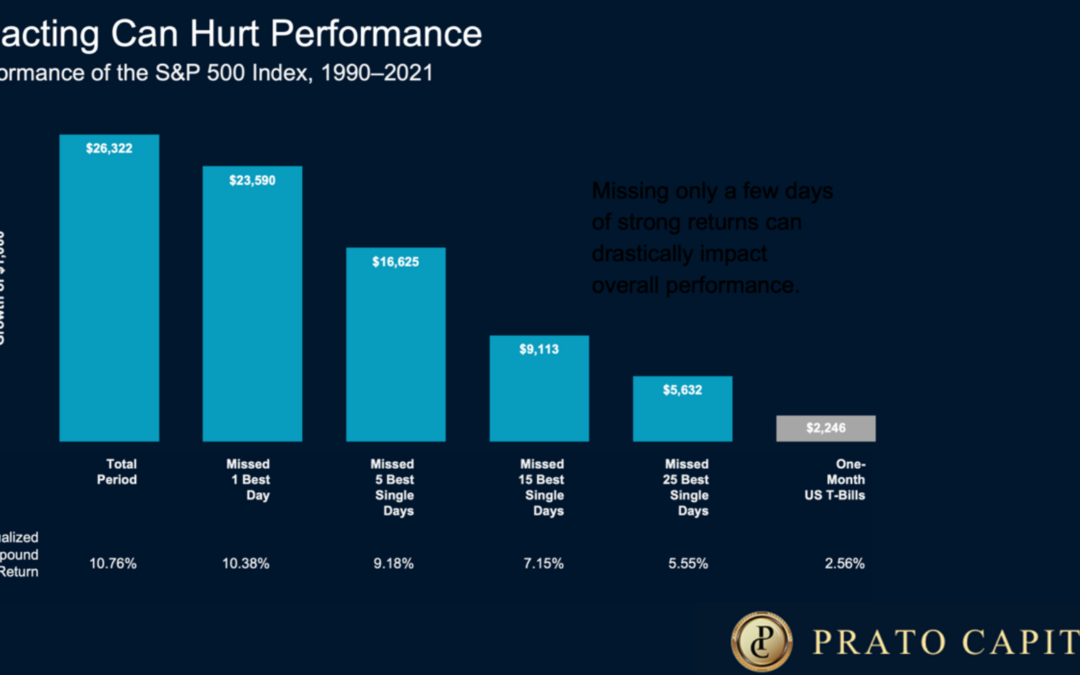

Selling stocks or funds now may prevent further losses, but also prevent any possible gains. There is no way of accurately predicting what the stock market will do tomorrow, next week or next month. Selling stocks now is only one decision that needs to be made. The next decision is when to buy again. That choice is often much harder to make. Just missing a few days of high percentage gains in the stock market can have long and lasting impacts.

- How can I keep up with such high inflation rates?

The inflation rates over the past year have been much higher than anyone anticipated, including the Federal Reserve and other government officials. Although it may not look like it today, the best long- term method to stay ahead of inflation is with a balanced and diversified portfolio of stocks and bonds. Our May 2022 Newsletter looks back at how inflation has added to our costs and compares that to how a broad stock index has performed over the last 50 years, this includes the last time we saw inflation this high. - When will this bear market end?

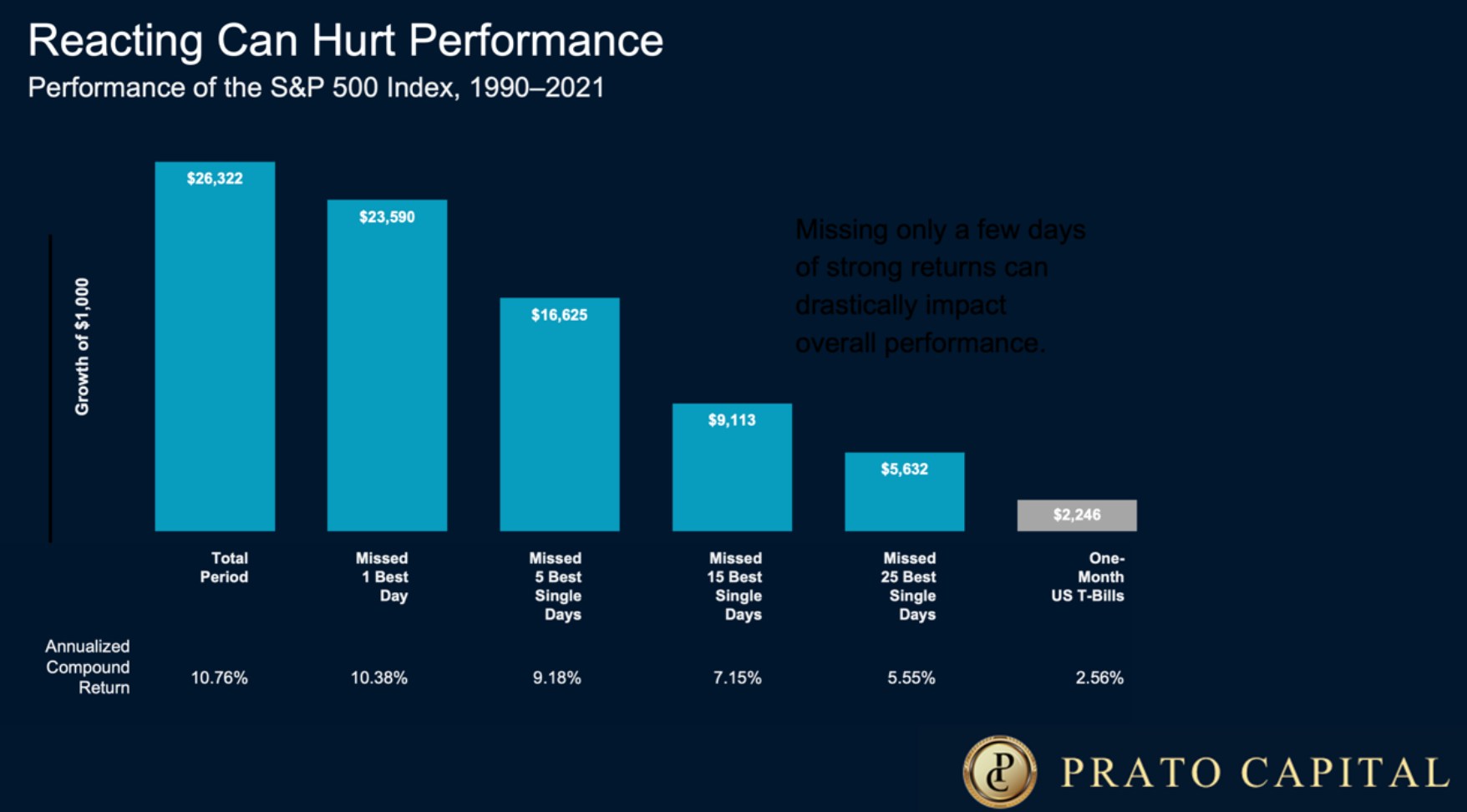

The simple answer is nobody really knows. All we hear in the news are the opinions of the commentators, analysts and everyone else who gets in front of the camera or microphone. When the stock market starts the next bull market, it is not announced with any fanfare and often goes unnoticed. Many of those in the media will not believe it happened, just like we saw in 2009 and in 2020. The chart below shows what happens when a long-term investor stays invested through both bull and bear markets and the major events we hear of in the news.

- Is my Financial Life Plan (FLP) at Prato Capital still valid with this bear market?

Yes. The planning process we use includes periods of bear markets and market corrections. Most people will see several bear markets in their lifetime. We think your FLP should include periods when stocks rise, and when stocks decline.

Please call us if you have any concerns about your plan and we can review it with you.

Although we have written about many topics concerning investing and financial planning over the past few years in our newsletters and blogs, we know that sometimes it is best heard directly from one of us on the phone or through email.

Please call or email us anytime with any concerns, questions, or even if you just want to talk. We are always available for our clients.

Greg, Gabriella, Brian, Samer, and Chris