Federal reserve building in Washington DC, District of Columbia, USA. Flat design vector illustration.

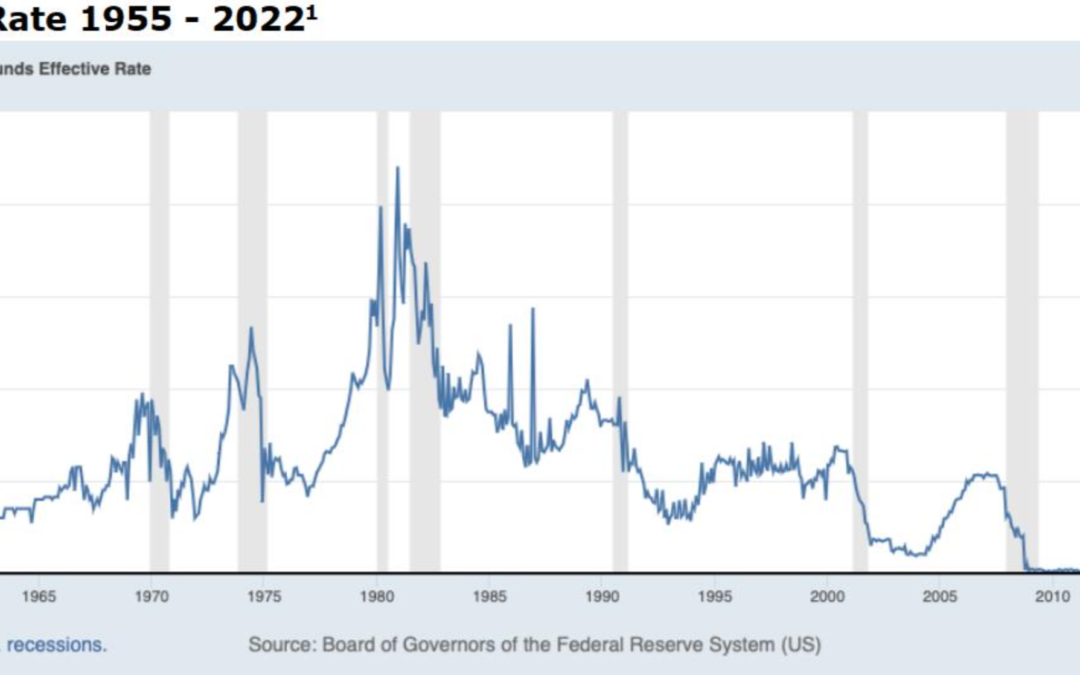

Since the start of this year, many commentators and analysts have been asking this very question – Is the Fed getting it right?

They continue with more questions: Are interest rates being raised too fast? When will rates decrease? Will high interest rates drive the economy into recession? And so on.

Asking the wrong question

The Federal Reserve is going to raise interest rates as they see fit, regardless of how many in the media are criticizing them. The Federal Reserve is not asking for opinions. They will do what they see as necessary, whether financial analysts or commentators like it or not, and there isn’t much we can do about that. That is the situation we find ourselves in today.

The question that should be asked and truthfully answered is – What advice are we offering to best serve our clients in a difficult economic and investing environment?

Many of these analysts and commentators are financial advisors that have clients relying on them to help navigate through this situation and help them reach their financial goals. But it seems like they are only contributing to the noise being generated in the media.

What advice are we offering

At Prato Capital, each client has a unique and individual set of financial goals that require different advice. But generally, there are some similarities in the advice we offer. We do not change our advice based on hunches or the noise generated by those in the media. We still advise sound investment strategies based on academic research and almost 100 years of data.

A portfolio with a balance of stocks and bonds appropriate to our client’s financial plan and financial needs is the foundation.

For short-term financial needs and goals, fixed-income and money market funds are preferred. Yields on money market funds have increased and they provide quick access to funds if needed. Within fixed income, we prefer short-term to long-term since interest rates are still rising. Shorter-term bonds have not seen the volatility and sharp declines associated with longer-term bonds this year. There will come a time when we think it is appropriate to move from a short term to a more balanced fixed income portfolio, but the time is not right yet.

For the stock portion of the portfolio, it is not surprising that we recommend a balance of US and international stocks. The forecasts of a possible recession and the slowing of corporate earnings make diversification very important. History has shown that market returns before and during

recessions have been both positive and negative, but once a recession ends market returns have been overall dramatically positive. We do not recommend trying to time the market. We have written many times that a strategy of market timing does not work. Every bear market we have seen in the past has been followed by a bull market.

For our clients who are long-term investors with a financial plan, short-term volatility is just that – short-term. Part of our job as their advisor is to ensure they look past the short-term volatility and look forward to the long-term successes.

David Booth, Chairman of Dimensional Funds, wrote an interesting article looking back over the past 25 years and how stocks have performed throughout some turbulent times. We highly recommend this: “Worried About Stocks? Why Long-Term Investing Is Crucial”.

Conclusion

You have not seen any of us at Prato Capital second-guessing Federal Reserve officials in the media. These are turbulent times in the financial markets and our clients look to us to guide them towards their goals. Creating more noise in the media is not looking out for our client’s best interests.

Our focus is and always will be on our clients. Our goal is to help them reach their financial goals which include retirement, buying a house, and paying for their children’s education. These are the most important goals of our clients, and they are our most important priorities.

Gregory, Gabriella, Brian, Samer, and Chris

“The best way to measure your investing success is not by whether you’re beating the market but by whether you’ve put in place a financial plan and a behavioral discipline that are likely to get you where you want to go.” – Benjamin Graham

Prato Capital: Where Integrity Meets Discipline