Services

Comprehensive Planning and ManagementPRATO CAPITAL’S PROCESS

By providing a complete investment solution for individuals, families and small to mid-size businesses, Prato Capital Management helps our clients achieve their financial goals with detailed financial planning and customizable portfolio construction.

Financial Planning

Most People Don’t Plan To Fail, They Simply Fail To PlanFinancial planning is the roadmap to a secure and fulfilling life, as YOU define it. We consult but most importantly we listen. We provide comprehensive planning to create a personalized Life Plan. Not just for investments—but for everything from debt management to college funding to generating the retirement income you’ll need for a safe and comfortable retirement.

Comprehensive, Personalized Plans

Our planning process starts with getting to know you and your needs in the depth and detail we need so we can build the Life Plan you deserve. Based on this Life Plan we create a comprehensive set of recommendations that may include:

- Cash-flow optimization

- Loss of Income protection

- College Funding

- Retirement funding

- Social Security maximization

- Risk management

- Charitable giving

- Estate planning

Financial planning is an ongoing and dynamic process that includes ongoing implementation and continual monitoring with course corrections as needed. We are great listeners. With your feedback in hand, we use our over 25 years of planning experience to help you make informed financial decisions.

Estate Planning

Proper estate planning helps to ensure that your heirs receive the greatest amount of your wealth possible, in an easy and efficient manner. It often goes hand in hand with charitable giving.

We provide guidance for giving to the people and causes that are important to you in two ways: During your lifetime, and at the settlement of your estate.

Retirement Incoming Planning

We guide and support clients in building a plan for income distribution after retirement.

Retirement income planning involves working together to identify your retirement income needs, then creating two things:

- An in-retirement portfolio that, along with Social Security, pension and any other income sources, provides steady income while allowing for needed growth.

- A spending strategy that can keep you from overspending—or living with unnecessary, fear-based frugality.

If your employer has a traditional pension plan, check to see if you are covered by the plan and understand how it works. Ask for an individual benefit statement to see what your benefit is worth. Before you change jobs, find out what will happen to your pension benefit. Learn what benefits you may have from a previous employer. For those who are married, you could possibly even qualify for benefits from your spouse’s plan.

Risk Management

Wealth takes a great deal of time and work to achieve, but it can be lost quickly. That’s why risk management is essential for those who wish to sustain their wealth and potentially pass it on to multiple generations.

We utilize Riskalyze to identify your acceptable levels of risk and reward. Together we can take the guesswork out of your financial future.

The Financial Planning Process

- Establishing and defining the relationship with a client

- Gathering client data

- Analyzing and evaluating the client’s financial status

- Developing and presenting financial planning recommendations

- Implementing the financial planning recommendations

- Monitoring

Wealth Management

Investment success begins with a complete understanding of your particular financial circumstances.Working with our clients, alongside their trusted tax, estate, and other advisors, we develop an understanding of key financial goals and priorities. Next we layout a specific financial and investment plan taking into account each client’s particular investing temperament and financial needs. Finally we implement the investment program to achieve the client’s goals.

All along the way, our clients benefit from our boutique client-service model where the team knows them by name. As a Registered Investment Advisor directly registered with the SEC, we are fiduciaries for our clients, sitting on the same side of the table as we make investment decisions.

After we begin to invest, we pride ourselves on regular, pro-active communication with our clients to keep them apprised of any changes in the markets, as well as to understand evolving needs and desires. Our clients receive clear and transparent reporting each quarter that shows how their investments are performing. As well, we provide additional thought leadership resources surrounding topics that are relevant to our clients.

We are active “asset allocators.” We believe the best way to navigate financial markets is to assemble highly diversified portfolios across a wide range of asset classes. Using our background and expertise as bottom-up investors, we closely watch markets to find asset classes and sectors that look attractive. Once we have found a potentially attractive area for investment, we search for the most cost effective way to obtain exposure to the potential returns. Our portfolios use a mix of individual Stocks, ETFs, and actively managed mutual funds, as well as bonds. For the majority of our clients we seek to manage downside risk as capital appreciation is just part of their investment objective.

Equity – For the equity portions of our portfolios, we manage two primary approaches:

Core Satellite – Indexed exposure to large-capitalization stocks through individual stocks and low-cost exchange traded funds. Allocation to mid- and small-capitalization stocks and international securities is accomplished again through low-cost exchange traded funds and no-load, low fee and more tax efficient funds. Our Core Satellite approach is a broadly-diversified offering with an emphasis on regular re-balancing and keeping total costs (management and underlying investment) low.

High Quality Dividend – Purchase of primarily large-capitalization stocks with strong balance sheets, an attractive dividend yield, and a record of increasing dividends.

Fixed Income – “More Money Has Been Lost Searching for Yield than at the Point of a Gun”

We believe risk-taking is better suited for the equity portion of a client’s portfolio and thus focus our fixed-income investments on investment grade government and corporate issues. When we do venture towards higher yielding bonds we use a diversified approach using Exchange Traded Funds and best in class Managed Mutual Funds whose research teams have the time and expertise that allow us to gain the proper exposure without assuming extra ordinary risk. We purchase bonds direct from institutional brokers and do not inventory or mark-up bonds.

Alternative – For public ‘alternatives’ to traditional equity/fixed income exposure we will utilize select REITs and opportunistic commodity-related investments, and certain actively managed mutual funds with a history of uncorrelated yet attractive risk-adjusted returns. Where appropriate, we maintain extensive relationships with third-party hedge fund, private equity, venture capital, and real estate focused partnerships.

Sustainable Investing

Investing with Values

Much is mentioned today about “Sustainable Investing” but what exactly does this mean to us as investors?

Sustainable Investing is so much more than greenhouse gases and climate change.

- It is about companies doing the right thing for their employees and communities.

- It’s about companies doing the right thing in the corporate offices.

- It’s about companies doing the right thing for the world we live in.

- It’s about companies doing the right thing… period.

Sustainable Investing has been around for over 30 years but has always made investors feel that had to ‘sacrifice’ returns for their values.

Did you know that you can now integrate your personal values and beliefs with your investments and still meet your Financial Life Plan needs?

By investing in companies that incorporate the issues of Environmental, Social and Governance concerns (ESG investing) we can “do good for this world and do well”.

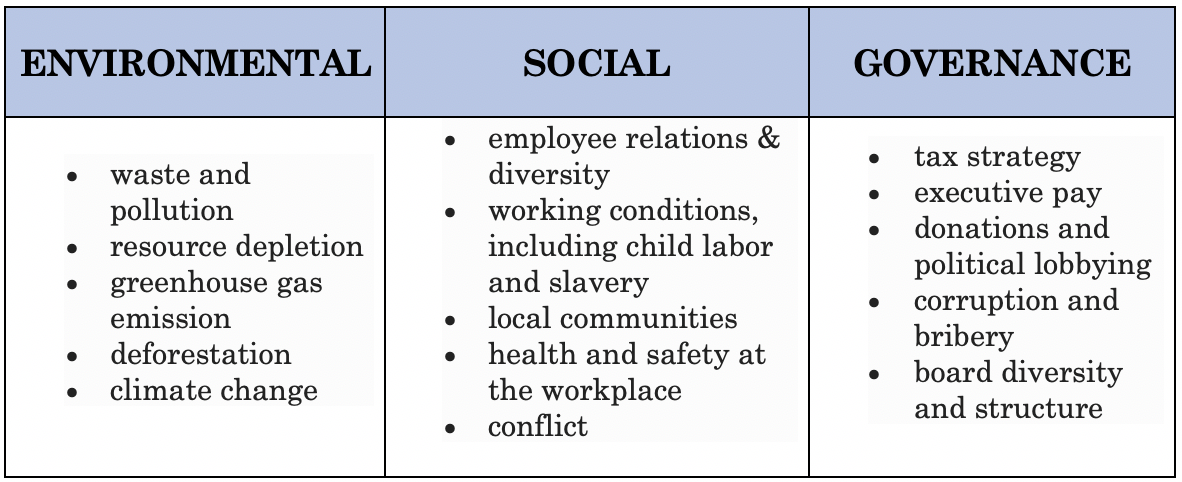

ESG – A Framework for Investing With Values

Some examples of Environmental, Social and Governance Issues

At Prato Capital we believe that over the long term, better business practices make better companies, better investments and a better world.

Do you have a plan?