It has been quite the week in the economic and investment fields. The mainstream news and business programs have devoted a lot of airtime to this week’s news of the S&P 500 entering a bear market¹, the Federal Reserve raising the benchmark interest rate by 0.75% and the increased chatter of a possible recession sometime in 2023 or 2024.

Bear Markets

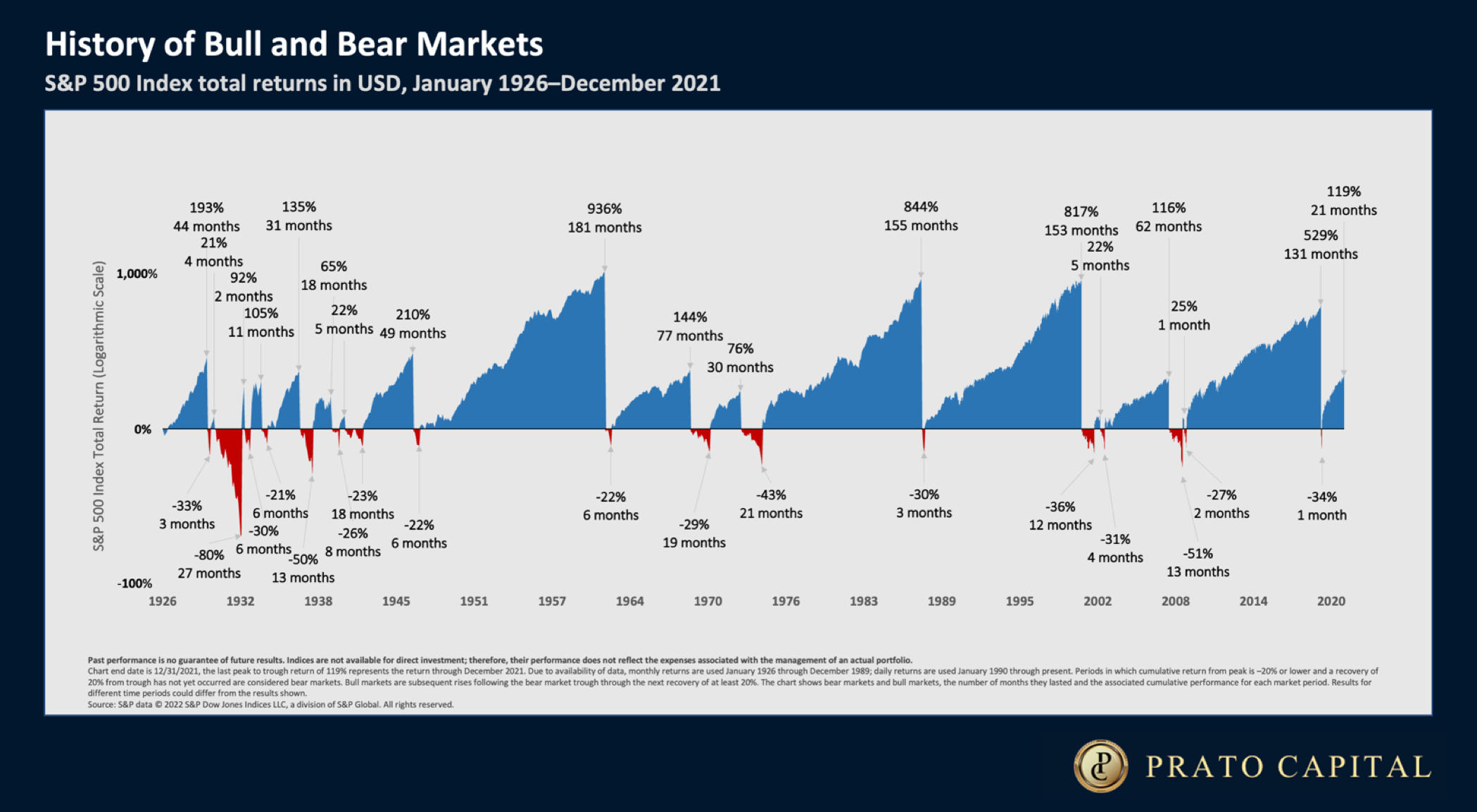

The chart below, shows the history of both bull and bear markets since 1926. Over the last 95 years, the S&P 500 has returned an average of about 10% through the ups and downs of the market. A quick look at the chart shows much more blue colored area signifying a bull market when compared to the red color of a bear market. This shows that significantly less time is spent in bear markets when compared to bull markets, meaning markets rise for longer periods of time. Markets also gain much more during bull markets than they lose during bear markets.

For almost a year now, we have discussed market corrections and bear markets, see our July 2021 newsletter and April 2022 Blog. This does not mean we are pessimistic or invested “defensively” as some pundits on the media are prone to say. It means that we maintain a balanced and diversified portfolio tailored to each client’s risk tolerance and the goals of their financial plan. We realize that bear markets are a normal part of investing in the stock markets and it is important to have an investment strategy that our clients are comfortable with and can follow through the bear markets and the bull markets. The preparation for bear markets starts during the bull market.

During market downturns, a few of the investment strategies that may be appropriate for some investors are tax loss harvesting and portfolio rebalancing. These can be beneficial in certain situations when markets decline.

Rising Interest Rates and Recession Talk

The Federal Reserve raised the benchmark lending rate by 0.75% this week to try to slow the economy and combat the high inflation rates we have seen recently. The immediate result will be higher interest rates on all consumer loans to include mortgages, car loans and credit card interest. The longer-term outcome as the economy slows can be potential job layoffs and maybe a recession.

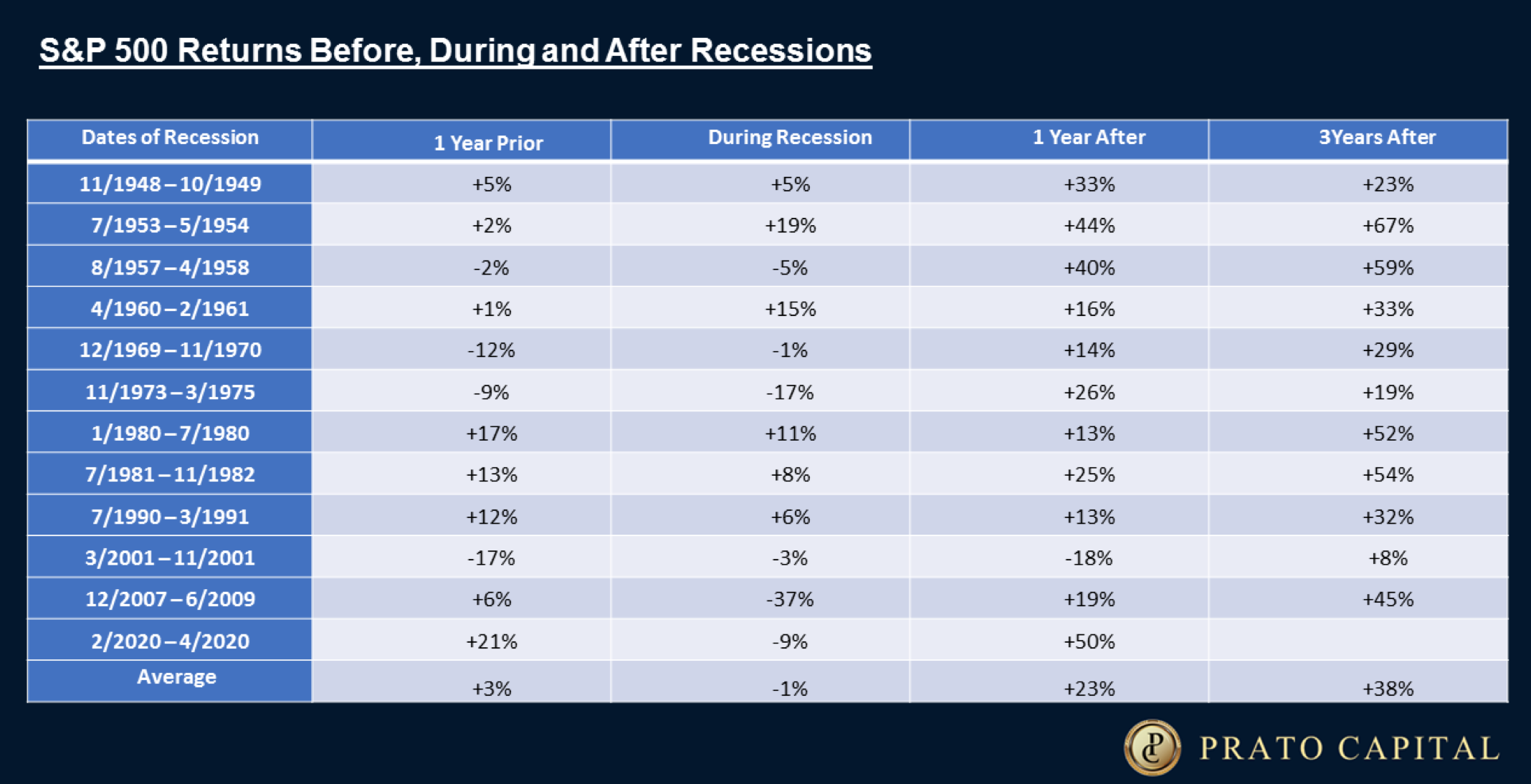

A recession is a period marked by a “significant decline in economic activity that is spread across the economy and that lasts more than a few months”². Since our clients are long-term investors, our intent is to see how a possible recession may impact stock markets and their portfolios in the future. When we use history as a guide, we can learn lessons from the past as we look toward the future. The chart below shows recessions in the US economy since the end of World War II and the S&P 500 returns before, during and after those recessions.

When looking at this chart, it is difficult to see a pattern correlating stock returns and recessionary periods before or during an economic slowdown. But, there is a clear pattern of strong stock market returns as the economy grows again after a recession.

What’s the Long-Term Investor to do?

We have said this many times before, but the best course of action for most investors is to have a valid financial plan, especially during uncertain times like we are seeing now. A valid financial plan, like the Financial Life Plan (FLP) we offer our clients, allows changes to most variables including inflation, income or loss of income, and probable future returns on investments providing a useful view into possible future financial outcomes, like saving for college or retirement. Valuable insights can be gained about how likely future goals can be achieved and if small changes made now can make big differences in the future. With the FLP we offer our clients, volatile times like we are seeing now are built into the plan. Increased inflation rates and market ups and downs are factors accounted for in a plan and when combined with inputs like income, investments and future spending an accurate view emerges of what the future can hold financially.

The financial news channels will soon introduce advisors and analysts that “called the bear market of 2022.” But, history has shown, and academic research has proven that accurately predicting the direction of the stock market is impossible. Our investment strategy keeps working through the market ups and market downs. The disciplined investment approach we employ is key to capturing the gains when they happen while allowing us to always work in our client’s best interest.

We recommend a short article from David Booth, the Executive Chairman and Founder of Dimensional Fund Advisors about long-term investing through uncertain times, https://www.dimensional.com/us-en/insights/worried-about-stocks-why-long-term-investing-is- crucial.

If we can answer any questions about uncertain times like we are seeing now, please call or contact us.

Gregory, Gabriella, Brian, Samer and Chris

Prato Capital: Where Integrity Meets Discipline

¹ Individual stocks and other stock indices can all be considered in a bear market if the price has dropped more than 20% from its previous high. The NASDAQ Composite entered a bear market in March 2022 and the Dow Jones Industrial Average has not entered a bear market as of 6/15/2022.

² National Bureau of Economic Research, https://www.nber.org/business-cycle-dating-procedure-frequently-asked-questions, June 16, 2022.