July 12, 2022

At Prato Capital, we receive lots of emails from investment firms looking for our business, meaning they want us to invest our client’s hard-earned savings with them. And recently many of these emails have highlighted their short-term returns that have outperformed the S&P 500 so far in 2022. We also hear about investments that provide portfolios that are ‘crash proof.’

Some of these investments sound too good to be true.

At Prato Capital, we look at many investments, including the ones that sound too good to be true. We feel very strongly about our fiduciary responsibility to our clients and investing their hard-earned savings and assets in their best interest and we are always looking for investments that best match our clients individual needs and risk factors over the long-term.

Fund “X”

Finding someone who can successfully time markets ups and downs sounds too good to be true to us. But we receive emails and phone calls all the time from fund managers that boast of their ability to do so.

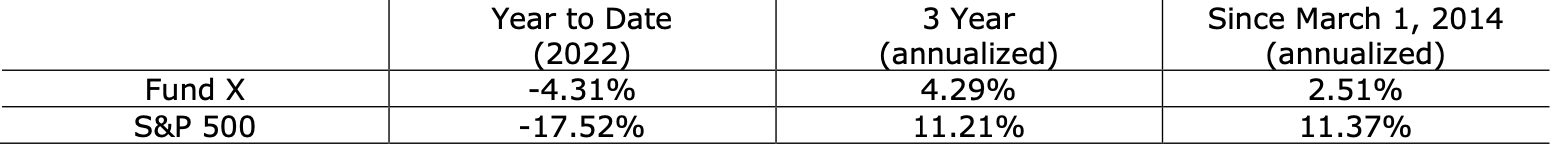

One of the emails that is typical of what we receive at Prato Capital comes from a fund manager in Louisiana, we will call this fund X. This fund considers its investment strategy as “A Liquid Mutual Fund. Managed like a Hedge Fund.” Our unsolicited email from this fund manager starts with fund X “remains in Cash (100%)!” and then brags about beating the S&P 500 over the first 6 months of 2022. This sounds like someone who thinks he can predict where the markets are going. There is much more here than the very restricted story that is being provided. Below are the returns for fund X compared to the S&P 500 over 2022, the past 3 years (to include the bear market of 2020) and since Fund X started in 2014.¹

Starting on March 1, 2014, an investor with a $10,000 investment would have seen it grow to $12,300 with fund X and $24,610 if invested in the S&P 500² (a 100% difference). Overall, Fund X has long-term lack luster performance and higher than average fees at almost 2%.

Many fund managers, including the one from fund X, make it sound like they know something that all other investors are missing. They want the world to believe they are smarter than everybody else and they can time the markets with precision. Unfortunately for them and those investing with them, none of that is true and their long-term fund performance shows that.

Crash Proof Portfolios

Does a retirement portfolio that is immune from stock market losses sound too good to be true? Most portfolios that are advertised as being able to withstand bear markets with little or no loss typically have little or no gain during bull markets. Many of these ‘investments’ are fixed income annuities from insurance companies with interest payments guaranteed over a specific time period or an index type of annuity based on a formula roughly matched to a stock index like the S&P 500. They also come with high fees, rate caps, steep penalties for early withdrawals and high commissions for those selling these products. For these products, the risk level may appear low but the returns on any investment are low. Over a 10-15 year time period, the actual returns generated by many of these annuities will fall behind the inflation rate, likely losing purchasing power every year of retirement.

These types of ‘investments’ enrich the insurance companies and the sales teams that sell them, not the people who rely on them.

Conclusion

Many advertisements we hear in the media intentionally prey on fear and doubts about running out of money when in retirement. Claims made in these ads sound good. In fact, the claims made are often too good to be true. These types of claims and the ‘investments’ they are peddling often do great damage to many investors trying to do the right thing with their hard- earned retirement savings.

We strongly believe these “investments” are not in the best interest of our clients and advise all investors to exercise caution with investments like these.

If you are considering investing in something that sounds like it can be too good to be true, please call us and let us investigate it.

“If it sounds too good to be true, it probably is.” –

Advice from everyone’s Father and Mother, including mine – Tom and Kathy Conway.

Gregory, Gabriella, Brian, Samer and Chris

Prato Capital: Where Integrity Meets Discipline

¹ Data for “fund X” and the S&P 500 received from YCharts, July 10, 2022.

² It is not possible to invest directly in the S&P 500. If invested in a generic S&P 500 ETF over the same time period, $10,000 could have grown to $24,540. Data from YCharts, July 10, 2022.