November 18, 2022

Over the past few months, we have discussed how the markets have been driven by news of inflation and interest rates. Many of our recent conversations with clients have revolved around these topics and specifically the fixed-income portion of their investment portfolios.

All Eyes on the Federal Reserve

Many commentators on the financial news outlets have talked about a “Fed Pivot” for several months now. This so-called “pivot” would involve the Federal Reserve, after having raised interest rates to then change course and lower rates again with the hope of preventing a larger economic slowdown than is necessary to control inflation.

However, when we look at what the Federal Reserve members are actually saying, a pivot in interest rates looks unlikely. Consensus thinking is that any change that does come (the start of the “pivot”) would be recognized when interest rates rise by.25% or .5% compared to the unprecedented .75% increase we have seen for several months now. Federal Reserve officials have consistently stressed that interest rates must level off for a period before any decreases occur. All of these officials have emphasized that they see inflation as a greater long-term risk to the US economy than a possible recession.

What Are Normal Interest Rates?

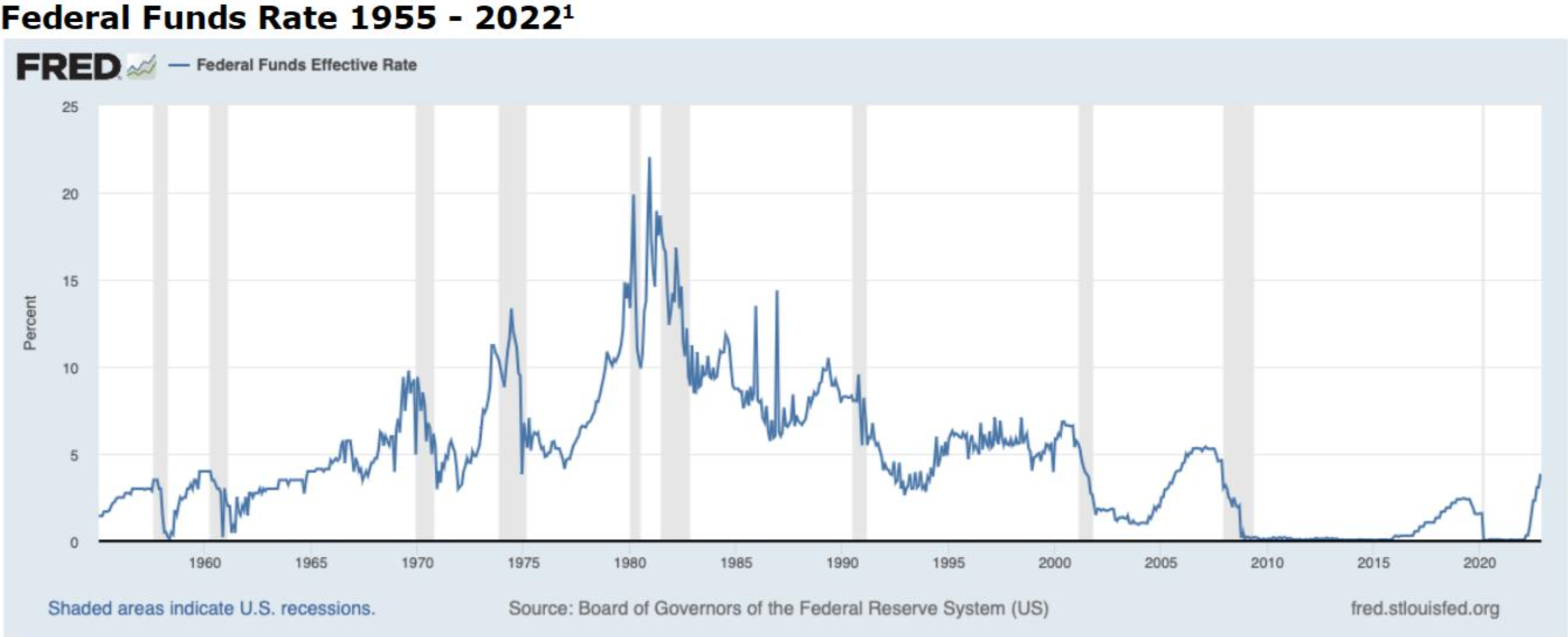

The chart below shows the Federal Funds Rates from 1955 – 2022. Over this period, rates have been as low as 0% and as high as 22%. Over the 36-year period from 1965 to 2001, the interest rate rarely fell below 5%. When looking at this chart, interest rates at or near 0% as we have seen since 2009 are not historically normal, just as rates like those seen in the 1970s and 1980s at or above 10% are not historically normal either. Over the past 77 years, a reasonable case could be made showing that historically the normal range of interest rates falls in the 3% to 6% range.

Many economists expect the Federal Reserve to pause raising rates in 2023 when they reach a range of 5% to 5.5%.

Fixed Income Strategies

In the past, as interest rates would increase, investors would use shorter duration fixed income bonds or funds and wait for rates to approach a peak. This would be less volatile than longer-term bonds while still receiving interest income. After a Fed Pivot, investors could then transition to longer durations and capture that higher rate of return as rates then started to drop back to a more normal level.

Presently, the cycle of interest rate increases we are seeing is different. If we remain in a historical range for interest rates, we may see rates fall 1% or 1.5% over the next few years, but with inflation as we have seen recently, rates returning to at or near 0% seem unlikely. It also looks like a sharp reversal in the direction of interest rates, the Fed Pivot, is unlikely too.

For now, interest rates are still increasing and remaining invested in short-duration bonds and bond funds, and reinvesting the dividends and interest remains the best course of action for most investors with the less volatile fixed-income portion of their portfolios. Yields are slowly increasing with this group and that will add to the overall value of these investments.

Conclusion

Many of the expectations of future interest rates are dependent on the inflation rates slowing. So far this year we have seen inflation rates remaining higher than anticipated causing the Federal Reserve to raise interest rates more than expected. The Federal Reserve is likely approaching the end of this cycle of raising rates but for now, they are still increasing. Officials have emphasized not to expect a “Fed Pivot” any time soon.

In this interest rate environment, we recommend our clients remain in the short-term bonds in the fixed income portion of their portfolios and continue to reinvest any dividends or interest received.

“We’ve done a lot, but we have additional work to do both on raising rates and sustaining restraint to bring inflation down to 2% over time.” –

Federal Reserve Vice Chair Lael Brainard interviewed by Peggy Collins of Bloomberg News on 11/14/22.

Gregory, Gabriella, Brian, Samer, and Chris

Prato Capital: Where Integrity Meets Discipline

¹ Board of Governors of the Federal Reserve System (US), Federal Funds Effective Rate [FF], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/FF, November 17, 2022.