At an economic policy symposium in Jackson Hole, Wyoming, Federal Reserve Chair Jerome Powell said, “Price stability is the responsibility of the Federal Reserve and serves as the bedrock of our economy. Without price stability, the economy does not work for anyone. In particular, without price stability, we will not achieve a sustained period of strong labor market conditions that benefit all.”¹

For the Federal Reserve Chair, this was a strongly worded statement signaling the importance of controlling inflation and the continued policy of raising interest rates. Since those remarks on August 26, 2022, the stock markets have seen more volatile swings, down initially and then with some modest gains to end last week.

At Prato Capital, we normally don’t comment on short-term stock market moves but keep our comments and articles focused on trends that may affect returns over a longer period. This is in line with the focus of our clients and their long-term financial goals. But it is always important to look at the underlying issues causing any volatility. Just because we don’t always comment on short-term issues, we are still looking at them.

Interest Rates and Inflation

There are many different opinions about what impact rising interest rates will have on inflation and ultimately on economic growth.

The idea of raising interest rates to slow inflation starts with making borrowing more expensive and trying to slow spending. As an example, when the overall cost of a car loan increases, many individuals will reconsider purchasing that new car. The same is true for business. There comes a point where it is just too expensive to borrow funds for capital expenditures. As spending slows, so does the demand for goods and the theory is this will slow the rate of inflation. It will also slow economic growth and could risk a possible recession here in the US.

Like any group of individuals, economists have many different viewpoints on the impact interest rates will have on inflation and overall economic growth. Although the simplified version explained in the previous paragraph is the basis of many economic theories, discussions can become heated when the impact on the economy is discussed. Many other factors are involved when discussing interest rate hikes, inflation, and economic growth. Unemployment rates, consumer cash and debt levels, wages, and business balance sheets are just a few of the economic variables that are considered in these discussions.

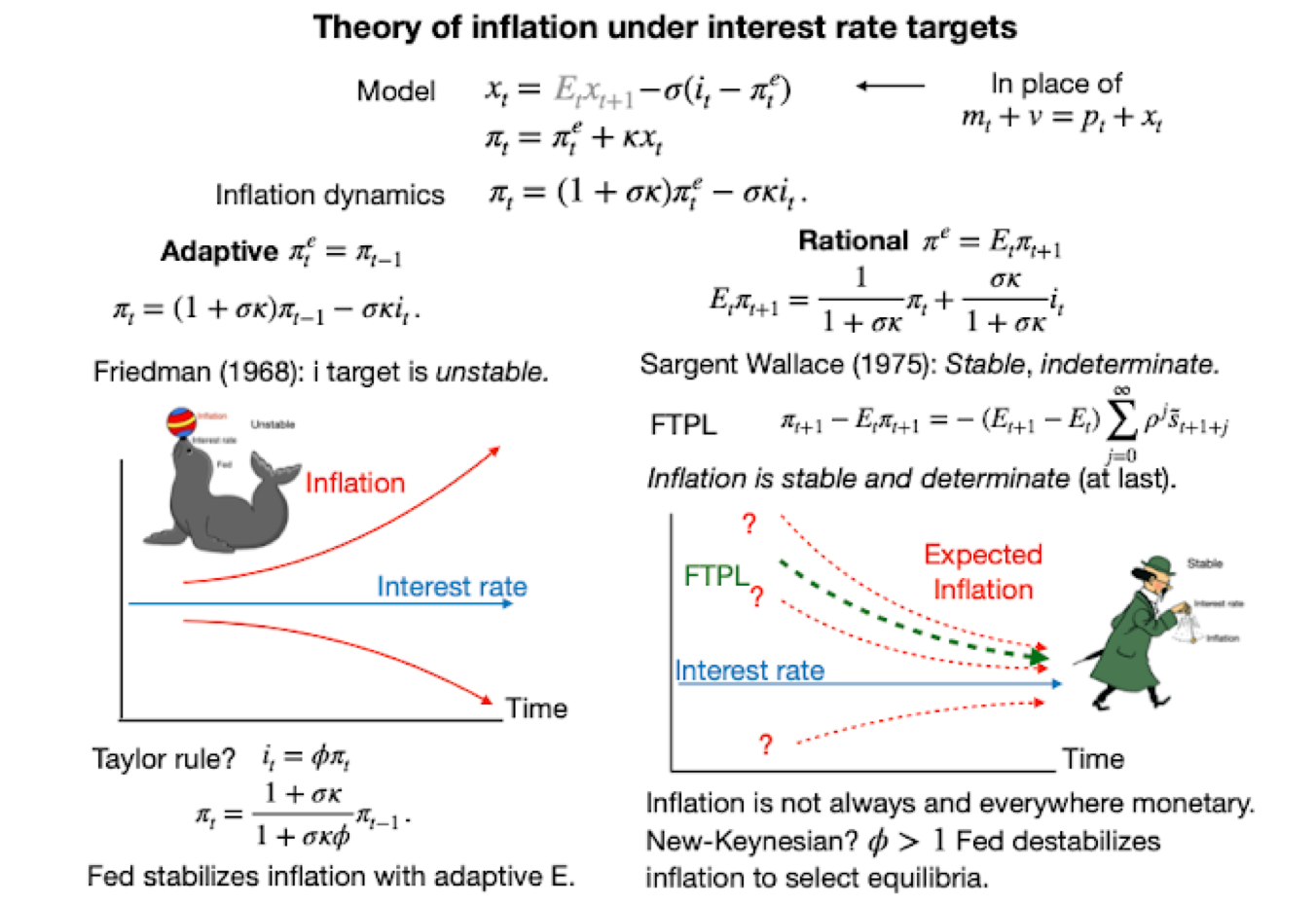

The illustration below is from John H. Cochrane, an economist and Senior Fellow at the Hoover Institution at Stanford University². This shows two different economic theories of interest rates and their impact on inflation. But more importantly, it shows that the relationship between interest rates, inflation, and ultimately economic growth is much more complicated than many on the financial news channels lead us to believe.

Looking at Volatile Stock Markets

Why did the markets react to the announcements from the Federal Reserve like they did?

Before the Jackson Hole symposium, many analysts were looking at the latest economic data, where the Consumer Price Index rose less than in previous months and the U.S. unemployment rate rose slightly, and they were hoping the interest rate hikes would start to taper off soon. The remarks by Chairman Powell eliminated much of that hope.

At Prato Capital, we have often said that market prices reflect all available information, and any new information will be priced in almost immediately. This was first put forward by Eugene Fama in 1970 with “Efficient Capital Markets: a Review of Theory and Empirical Work” and led to his winning the Nobel Prize in Economic Sciences in 2013.

The efficient market theory may help to describe why the stock market turns volatile at times and may best describe what has happened over the past couple of weeks. We often hear about uncertainty leading to volatility. As many of the large brokerage firms and mutual companies, who make up a large percentage of daily stock trading volume, reevaluated their overall positions, this created uncertainty and volatility within the markets as the new information was priced in. Although the markets may have settled over the past few days, there are still many conflicting views on the interest rate increases and the overall effects on inflation and economic growth. The media continues to create tension (noise) by broadcasting so many differing views without any kind of consensus. In our opinion, all of this adds to the uncertainty over the short term and may explain at least some of the volatility we have seen.

Conclusion

The relationship between interest rate hikes, inflation, and economic growth is complicated, much more complicated than many in the media would like us to believe. Although variables like supply and demand issues, wages, and debt levels are different each time our country has dealt with higher-than-expected inflation, history has shown that the U.S. economy is resilient and has been through scenarios like this before.

As always, we are available for any questions about the short-term volatility we are seeing, concerns about rising interest rates and any other questions or concerns.

Gregory, Gabriella, Brian, Samer, and Chris

Prato Capital: Where Integrity Meets Discipline

“Today every problem has several alternative solutions, and every answer raises several questions. I am more than ever convinced of the words once uttered by George Bernard Shaw: ‘If all economists were laid end to end, they still would not reach a conclusion’.”

– John F. Kennedy

¹ Jerome Powell, “Monetary Policy and Price Stability”, https://www.federalreserve.gov/newsevents/speech/powell20220826a.htm, August 26, 2022.

² John H. Cochrane, “Expectations and the Neutrality of Interest Rates”, https://johnhcochrane.blogspot.com/2022/09/expectations- and-neutrality-of-interest.html, September 8, 2022.