The new blockbuster film, “Dumb Money” gives us the inside scoop at how investors helped the prices of short-term “meme stocks” skyrocket. Should long-term investors buy into the “get rich quick” hysteria?

It’s not everyday, a short squeeze stock becomes the central plot of a film. At Prato Capital, we talked about short squeeze stock in our blog back in 2021, using Gamestop as an example. All hype aside, it is important to remember that price reflects the expected return demanded in aggregate by market participants to hold shares of a company. Equity markets process hundreds of billions of dollars’ worth of trades on an average day, so prices incorporate a potentially massive number of viewpoints on a company.

Investor preferences, such as the demand for “meme stocks” in 2021, also play a role. If market participants favor one company over another, the rate of return demanded to hold that company’s stock may differ for that reason alone. As an example- if enough shoppers are buying dark-colored cars, you may be able to get a considerable discount on that new, bright-yellow car!

Using history as a guide, market prices show us the stocks with higher expected returns. However, this is no match to specific considerations driving price differences. And of course, attempting to outguess or outsmart markets through a crystal ball is a no-no.

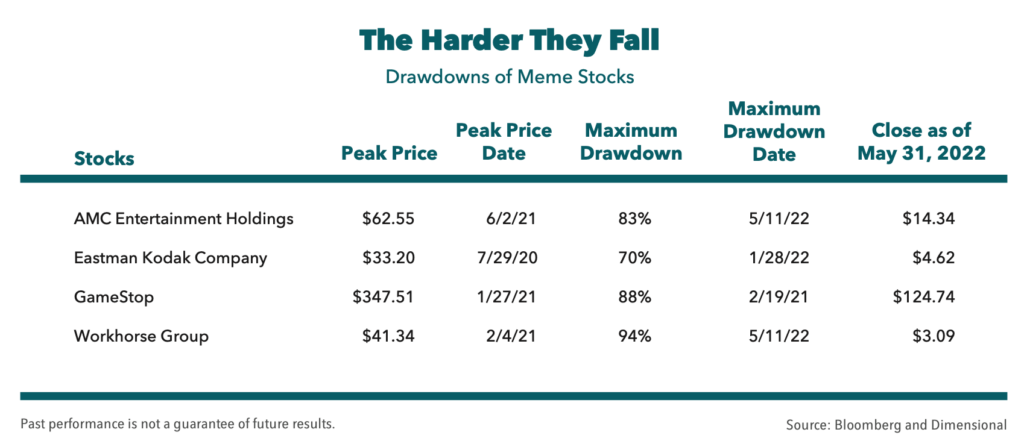

Putting all your investments to a short term fad of the day, like GameStop or AMC, exposes you to unnecessary risk as seen in Exhibit 1. The chances of striking it rich on one of these stocks is slim– basically, you would have to invest before it goes up and sell before the drawdown. Even if you manage to land a big winner once or twice, history has found that this luck is unlikely to repeat throughout a lifetime of investing!

The pandemic showed us a bunch of quick fads from crypto to Robinhood stocks. A lot of new investors dove into the market for entertainment purposes and potential riches, but many dropped out after experiencing the reality of the roller coaster of short term trading. While it can be difficult to tune out the “get rich quick” hysteria, doing so may save you and your finances from being taken on a wild ride. The potentially smoother journey that diversification offers may be less entertaining, but it generally makes for a better experience.

Long term investors that have a balanced and diversified portfolio matched to their risk tolerance have minimal exposure to stocks like Gamestop and the volatility it has caused. When we use history as a guide, we have seen that any short-term market changes from a short squeeze are just that – short-term.