Perspective

Today’s financial headlines only tell part of the story. The headlines are intended to keep viewers watching and raise emotions about the equity markets.

The part of the story the media is not covering is that after a decline of over 2% today, the S&P 500 is now at a level we saw only 2 months ago in July 2021 and is still up over 15% this year. The NASDAQ Composite is up over 13% this year and is at a level we saw just last month.

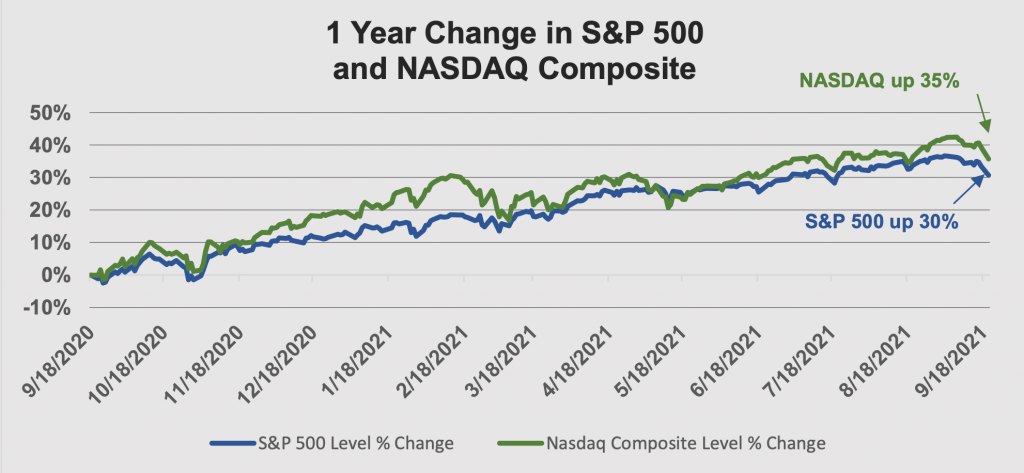

The chart below shows the returns for the past 12 months for both the S&P 500 and NASDAQ Composite. Even after the declines we have seen since the highs set for both indices earlier this month, we have seen greater than 30% returns in the last 12 months. It is important to have a longer-term horizon than just one day.

Value of Advice

At Prato Capital, our clients have investment plans that are focused on periods of time much longer than just a day, week, month or even a year. As part of a Financial Life Plan, these investment plans can span many years to include short- and long-term financial goals.

As advisors for our clients, we monitor markets, maintain portfolio discipline, and realize that volatility can be an opportunity to rebalance a portfolio. All of these actions are taken to keep our clients on track with their investment plan and the more comprehensive Financial Life Plan.

Short-term market volatility is expected to happen and is built into every investment and Financial Life Plan.

Here is a helpful video on timing the market:

To learn more and follow us on social media, visit https://linktr.ee/pratocapital