March 10, 2023

Last month we looked at the different sectors of the US stock market and could see the variability of returns of each sector from month-to-month and over the longer term, from one year to the next. This month, we are looking at different asset classes like segments of the stock and bond markets both in the US and International Markets.

While we often hear claims of which asset class should be “in favor” or which may soon meet their demise, the data can highlight both the difficulty in predicting short-term winners and how quickly the markets can change.

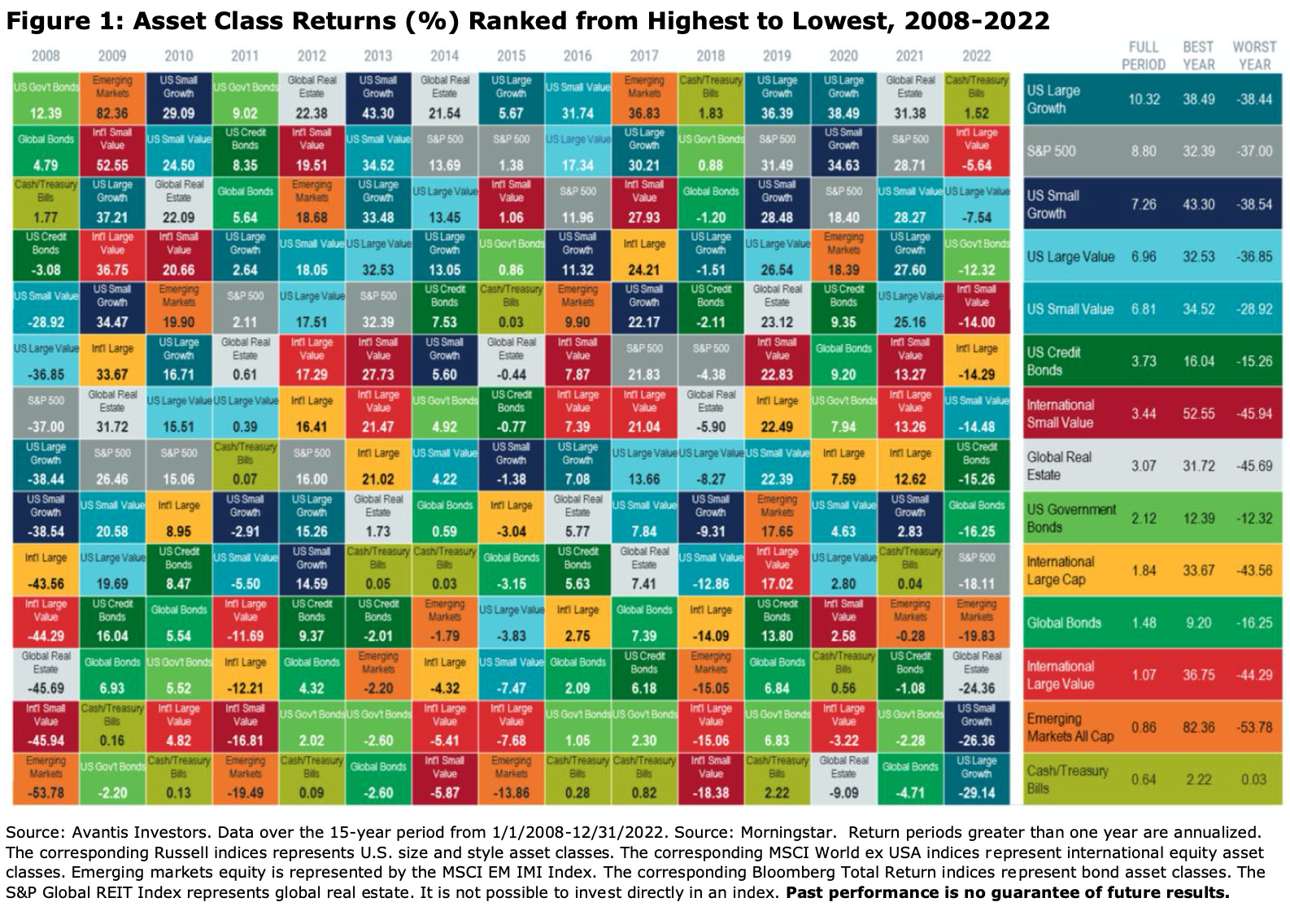

In 2022, cash was the top-performing asset class, besting US large-cap growth stocks by more than 30%, as shown in Figure 1 below. US large-cap growth stocks were the worst-performing asset class over the year after topping the charts in two of the prior three years. With the benefit of hindsight, it’s easy to say that cash did well relative to stocks and bonds over 2022 due to rising interest rates and heightened uncertainty. But picking which asset class will outperform in the future is nearly impossible.

Over the past several years we have published many charts that look like Figure 1 which we affectionately call “The Patch Quilt Chart” because, well it looks like one of grandma’s patch quilts. These so-called Patch Quilt Charts show the returns of various asset classes over different periods of time. When looking at these charts, it is easy to see that just because an asset class outperformed in one year, it does not mean that it can or will outperform again the following year. For those investors that have long-term horizons, like investing for college and retirement, it is important to capture the asset classes that do outperform. This is the benefit of a broad and globally diversified portfolio of stocks and bonds – capturing those asset classes that outperform every year. An added benefit to the broad and globally diversified portfolio is the reduction of overall risk by not relying on a single asset class to provide the returns.

What’s in a name?

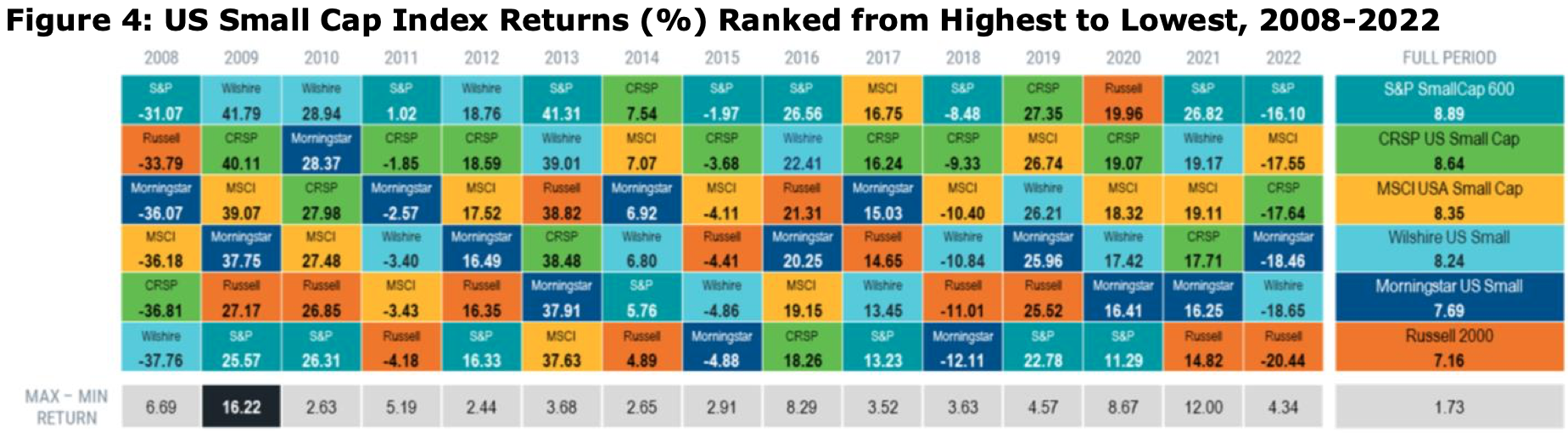

When looking a little closer at the different asset classes, a lesser-known fact is that there’s no single definition for what an asset class really is. While high variability of returns exists across different asset classes over time, the charts below show there’s also a high variability of returns for indexes within each asset class.

In Figures 2-6 below, we show calendar year returns for each of the last 15 years and annualized returns over the full period for indexes from well-known providers representing various U.S. equity market segments. The results highlight that these different measures of an asset class can yield meaningfully different returns despite labels that might suggest little difference between them.

Why Are Index Returns within an Asset Class So Variable?

The reality is that splitting the market into pieces requires making decisions about how each component will be defined. These decisions are subjective and vary from one instance to the next.

For example, how does one define a small cap company? A “value” company? A “growth” company? Different definitions lead to differences in the securities selected, differences in characteristics, and, as shown above, differences in returns. This highlights the difficulty some investors have in determining the proper investments for their portfolio.

Difference between an index and a portfolio

To try and match a specific index or sector, many investors will pick a professionally managed mutual fund or ETF to best mimic the asset class/sector returns. But as the charts above show, returns can vary considerably within the indexes and more often between different Mutual Fund/ ETF managers. What we at Prato Capital know is that not all professional managers carry the same discipline or integrity. Which is why we often end our emails with … ”Prato Capital, where integrity meets discipline”.

At Prato Capital, we believe there is a big difference between index investing and investing towards financial goals like a college education, future home purchase, vacation, and retirement for example. Yes, investing in funds that mimic indexes can help achieve positive stock returns over the long-term, but that is only a good start. Having a complete understanding of what the underlying investments are for each fund and ETF is imperative to ensure there are no surprises. Balancing the returns of each investment with the risk involved to help our clients achieve successful financial outcomes is just part of the value we add to a portfolio. Having a broad and globally diversified portfolio of stocks and bonds is a great start, but having an individual portfolio that matches the risk tolerance and goals of our clients is so much more than just index investing.

“Investing isn’t about beating others at their game. It’s about controlling yourself at your own game.”

– Benjamin Graham – Author and Investor

Gregory, Gabriella, Brian, Samer, and Chris

Prato Capital Management Where Integrity Meets Discipline