The financial media outlets have renewed talk about possible recessions, both globally and here in the United States. Our last two blog posts discuss some of the positives and negatives about the US economy and where we may be heading, https://pratocapital.com/blog/.

We are not saying a recession is in our immediate future, but it is always prudent to look at the longterm history of scenarios like recessions. On average a recession has happened once every 7-8 years in the US since 1945. The last recession ended over 10 years ago now. At some point in the future, a recession will occur in the US, we just don’t know when.

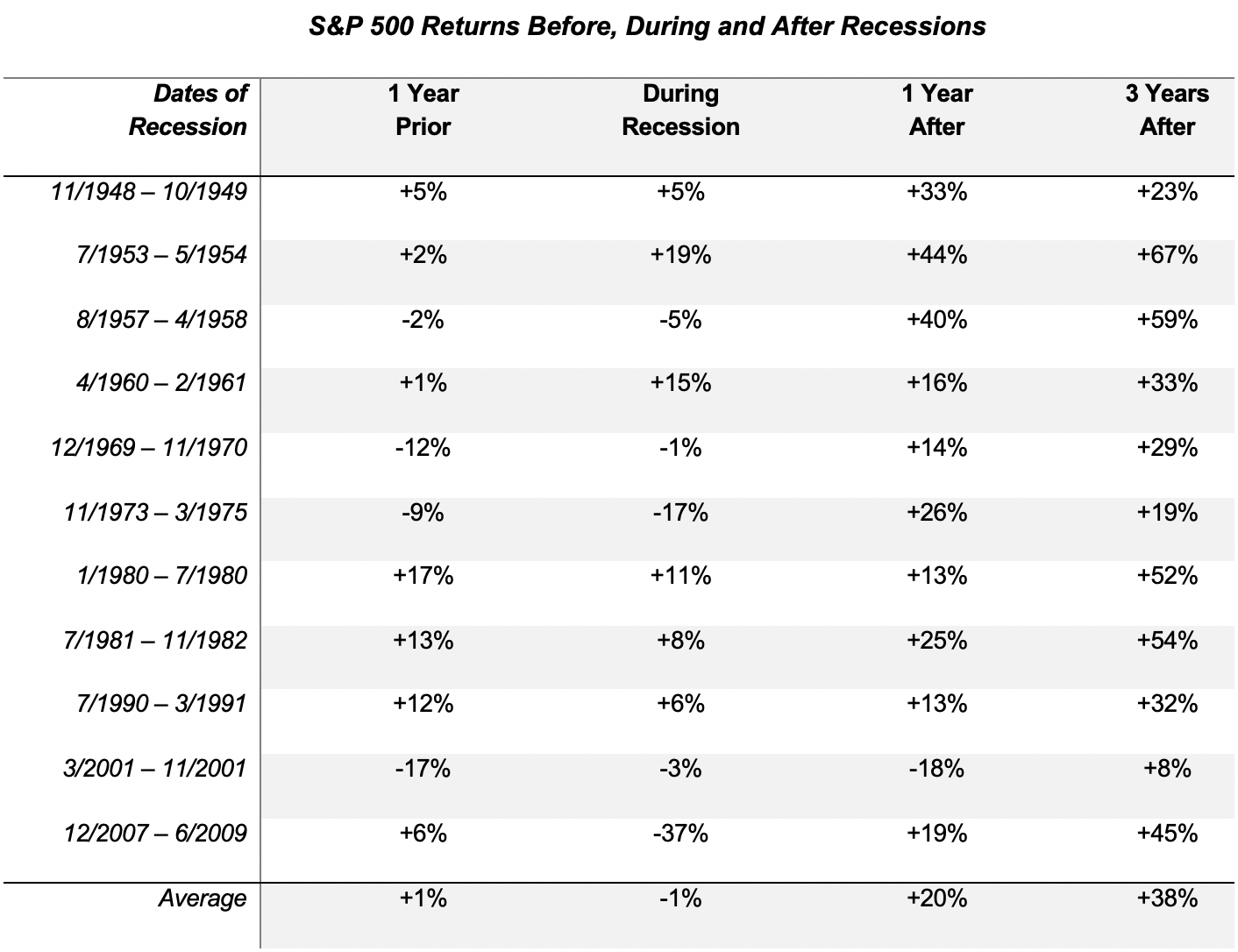

Most important for our clients is the impact a recession can have on their Financial Life Plan. Since the stock portion of the diversified portfolio provides most of the growth needed for your financial plan, how stocks perform during recessionary periods is important. Although there is some correlation between the economy and the stock market, it is not always the case. The chart below shows how the S&P 500 has done before, during and after recessions since 1945.

A few key points from the chart above:

- Stocks did not always decline during a recession.

- The stock market has not always been a ‘leading’ indicator of economic growth.

- Stocks have had considerable gains 1 and 3 years after a recession. The 2001 recession is the only exception during the 1 year period from 2001-2002.

A recession may lead to a stock market decline, or it may lead to a stock market gain. It is not only difficult to tell where the stock market is going, it is very difficult to tell where the economy is going as well. The organization that is responsible for determining whether the US economy has slipped into or recovered from a recession can take 12-15 months to make those determinations. It does not happen in real-time.

At Prato Capital Management, a portfolio that is diversified and rebalanced around the market ups and downs does not require trying to time the economy. Recessions happen from time to time. They are completely normal. We keep our investors on track by maintaining discipline through these very natural and expected ups and downs.

A Financial Life Plan provides the knowledge to look past the short-term thinking of the financial media outlets and as we like to say at Prato Capital ……“Tune Out the Noise”.