The stock market has been volatile so far this year. We have seen days with the major US averages closing with gains or declines of 2% several times already this year. With the headlines dominated by the Federal Reserve poised to raise interest rates, the highest inflation we have seen in decades and the war in Ukraine, some analysts and commentators have raised the possibility of the US economy entering a recession at some point in the future. This said, talk of a recession now is probably premature at best. The economy is on track to grow .5% in the first quarter¹ and added over 1.15 million jobs in January and February of 2022². Strong corporate earnings are expected to continue through 2022 with an estimated increase of about 5%³ over the very strong results from 2021.

Preparing

In the Prato Capital newsletter from July 2021, we discussed the benefit of preparing for market volatility and market corrections before they happen. Market history has shown over and over that volatility and declines are a normal part of investing. How investors react (or don’t react) to these situations can have lasting impacts on their portfolios. The same is true for economic changes like a recession.

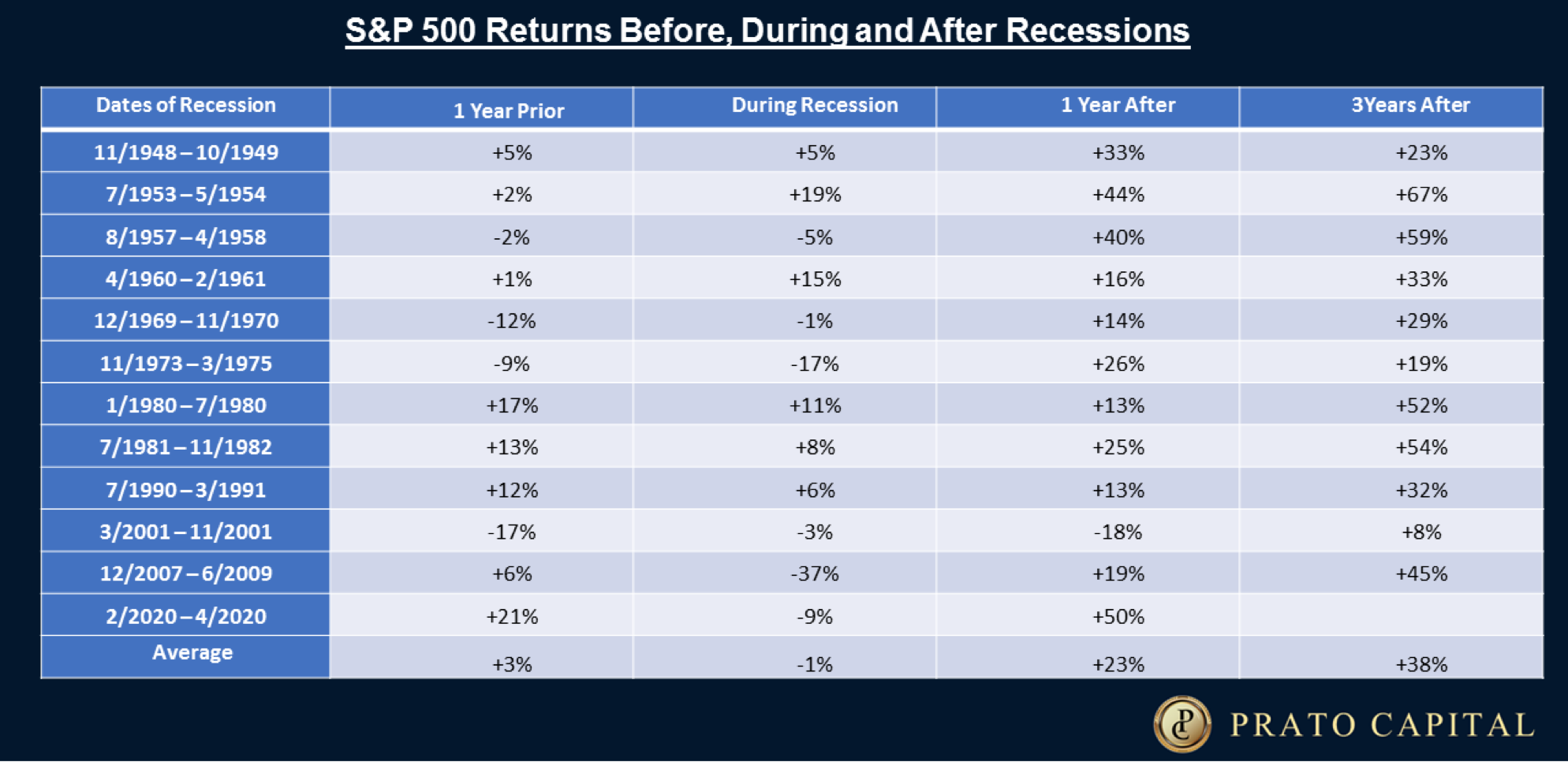

At Prato Capital, we feel very strongly that when we use history as a guide, we can gain some insights into how financial markets may react to events like a future recession. With all the noise in the media outlets concerning slowing economic growth and a possible recession, it is important to look at the facts of how markets have reacted in the past. Chart 1 below shows returns for the S&P 500 before, during, and after US recessions since the end of World War II. It is important to remember that recessionary periods are always looked at after they have started and after they have ended making them difficult to time as our May 2019 newsletter discussed. The returns below are based on the first day of the month when the recession started and the last day of the month when the recession ended.

As Chart 1 below shows, S&P 500 returns have been very resilient during recessionary periods. Even during the inflationary period of the 1970s and early 1980s, stock values did not always decline during the recessions and the periods after those recessions showed remarkable gains.

Chart 1: S&P 500 Returns and Recessionary Periods since 1945:

Conclusion

Rather than trying to time or predict when a recession or market downturn will occur, at Prato Capital we see it in our client’s best interest to be prepared for all market outcomes. Our focus is to collaboratively build an appropriate Financial Life Plan using long-term investment strategies inside a globally diversified portfolio to best meet our client’s financial goals. We have said it before but it’s worth repeating: “tune out the noise” of the financial media and stay focused on the long-term investment strategies. This truly builds wealth.

¹ GDP Now, March 8, 2022. Federal Reserve Bank of Atlanta. https://www.atlantafed.org/cqer/research/gdpnow.

² Employment Situation Summary, March 4, 2022. US Bureau of Labor Statistics. https://www.bls.gov/news.release/empsit.nr0.htm

³ John Butters, FactSet, February 4, 2022, https://insight.factset.com/sp-500-earnings-season-update-february-4- 2022#:~:text=Looking%20ahead%20to%20the%20first,%2Dyear%20average%20(16.7).