Last week, the Federal Government released the Consumer Price Index (CPI) data for May 2021. The headline number of a 5.0% increase in prices from one year ago has the become the subject of many news headlines. Inflation is always a concern for consumers and especially for those on a fixed income and this brings up two questions:

• Is inflation really a long-term problem for the US economy and consumer as some of the media reports suggest?

• If so, what should the long-term investor do about it?

Long-Term Issue?

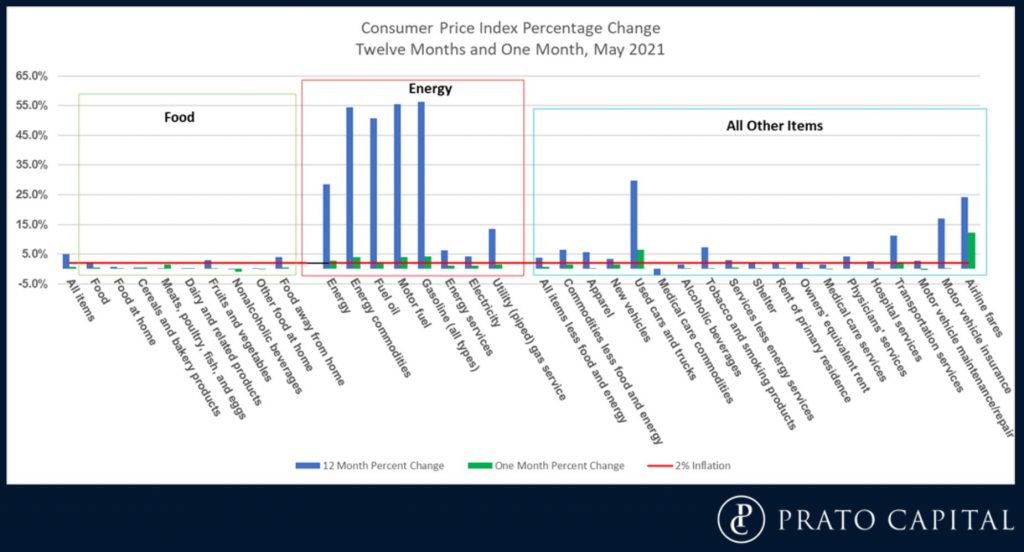

Our newsletter from April 2021 (click here to view) discusses inflation and the Federal Reserve’s policy about inflation. Since the beginning of April, the rate of inflation has increased. A little closer look at all of the categories making up the CPI number can provide some insight into whether we are seeing short-term or transitory effects on inflation or if it may become more persistent. Chart 1 below, shows all the categories that the US Bureau of Labor Statistics uses at to calculate the monthly CPI number. The categories are broken down into groups of food, energy, and all other items. When looking at these categories over the past 12 months, energy costs rose 28%. Other categories that saw high price increases were used cars and trucks, motor vehicle insurance, tobacco, and airline fares. When we look at some of these same categories in the May 2020 CPI report, airline fares were down over 28%, motor vehicle insurance was down over 14% and energy costs were down over 18%.

When looking only at the report for May 2021 without the context of the impact of the pandemic, it looks like inflation is a much larger problem than it may be. So far, much of the 2021 CPI data appears that most prices are adjusting back to pre-pandemic levels.

Chart 1: Consumer Price Index Categories Percentage Change, May 2021

What is the Investor to do?

Since 1971, the CPI has averaged a 3.8% increase per year. For a long-term investor, the best hedge against inflation is a diversified portfolio of stocks and bonds. Over the same 50-year period, the S&P 500 has returned an average 10.8% per year and a broad corporate bond index has returned 7.3%. These rates of returns include reinvestments of dividends and interest. The returns from stocks and bonds have outpaced the rate of inflation over the long-term and this is one of the best corrections an investor can make for inflation concerns.

To see if inflation really is a problem, having a valid financial plan that allows inflation rates to be adjusted will provide valuable insights. By changing the anticipated rates of inflation, the impact on future financial goals like retirement and college savings can be immediately seen and any adjustments to portfolio allocation or savings rates can be discussed. Small changes over long periods of time can make a big difference.

Conclusion

Is inflation going to persist into the future? Yes. But the reality is, we don’t know what the inflation rate will be next year or 5 years from now. Using history as a guide, the best preemptive move to counter inflation for the long-term investor is to have a balanced portfolio of stocks and bonds with a valid and continually updated financial plan. This can provide peace of mind about your financial future.

At Prato Capital, this is what we offer to our clients. If you are a long-term investor who is concerned about inflation and your financial future, give us a call. We can help.