Since late last week, the decision to attack Iranian General Qassem Soleimani has dominated the news cycles. With the need to fill up the 24-hour news channels with content, there is much speculation about retaliations and outcomes of any potential conflict that might arise.

Our focus at Prato Capital Management of any current event is the long-term impact on our clients’ Life Financial Plans. We have found that history can often be a guide for what to expect in the future.

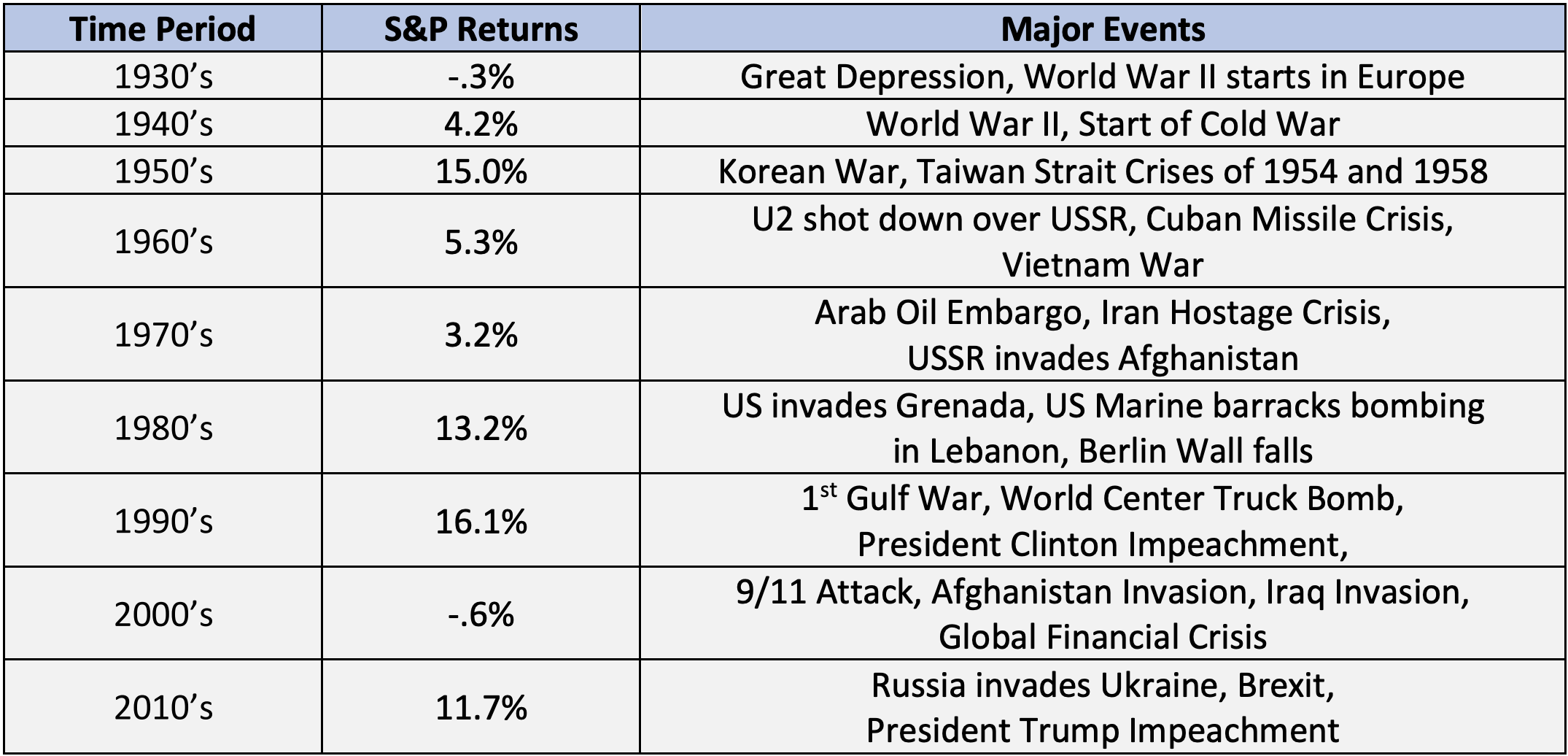

Since 1928, the S&P 500 has averaged about 7.7% annual return. Over all these years there have been some major wars, minor skirmishes and many diplomatic disagreements. There have also been many long and ongoing events like the India/Pakistan and Israeli/Palestinian conflicts.

Below are some major events and S&P returns since 1930:

Our view is that current events will always create uncertainty, but that uncertainty should not lead to fear and paralyze our actions for the future. Although stock market returns are impossible to predict in the short term, history shows that when looked at over a longer term, the returns become more reliable, averaging about a 7% gain annually. At Prato Capital Management, we find a diversified and balanced portfolio that is based on our client’s risk tolerance and financial goals does not require reacting to each and every current event to succeed. This is what our clients’ Financial Life Plan has planned for.

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.” – Peter Lynch.