Good Afternoon,

Summer is coming to an end and the swings in the stock market this week will confuse those that are not willing to trust history as a guide and are vulnerable to noisy media.

Investors that are lacking any concrete evidence of market history rush into the market on good days (like yesterday) and run away from the markets on bad days like today. Unfortunately, they succumb to the media and let the noise negate logic, strategy and history.

These are not speculative guesses. These are facts backed by market volume. Many investors just took their long-term investment plan and turned it into a 48 hour plan. This is sad.

With all due respect to these so-called “experts” in the media, today’s headline about an “Impending Recession” doesn’t bode well for those thinking they can outsmart history. For an example, in October-November of 2006, exactly one year before the Great Recession began, the 2-10- bond yield inverted. Equities did well in the first half of 2008 when we were in a recession and oil prices hit a peak in May of 2008 when we were very much in a recession.

Bottom line- Do not depend on equities or oil prices to inform you if you are or are not in a recession. You’re probably not going to do well using them as a leading indicator. But don’t tell the media that.

Here is some more useless information:

One team of economists at a major Wall Street firm say “three of the top five economic indicators of the business cycle are flashing yellow and are near levels consistent at the start of previous recessions.” A few paragraphs later they add add… “however the most reliable early indicator, initial jobless claims, remains at a low level.”

Another major bank headline includes a model that suggests there is “a 20 percent chance a U.S. recession will occur in the next 12 months”…

To me what they are saying is that there is an 80% chance there will NOT be a recession..but that’s just me.

Truth of the matter is, analysts get paid to fortune tell. They are rarely right and when they are it is meaningless to the long term investor.

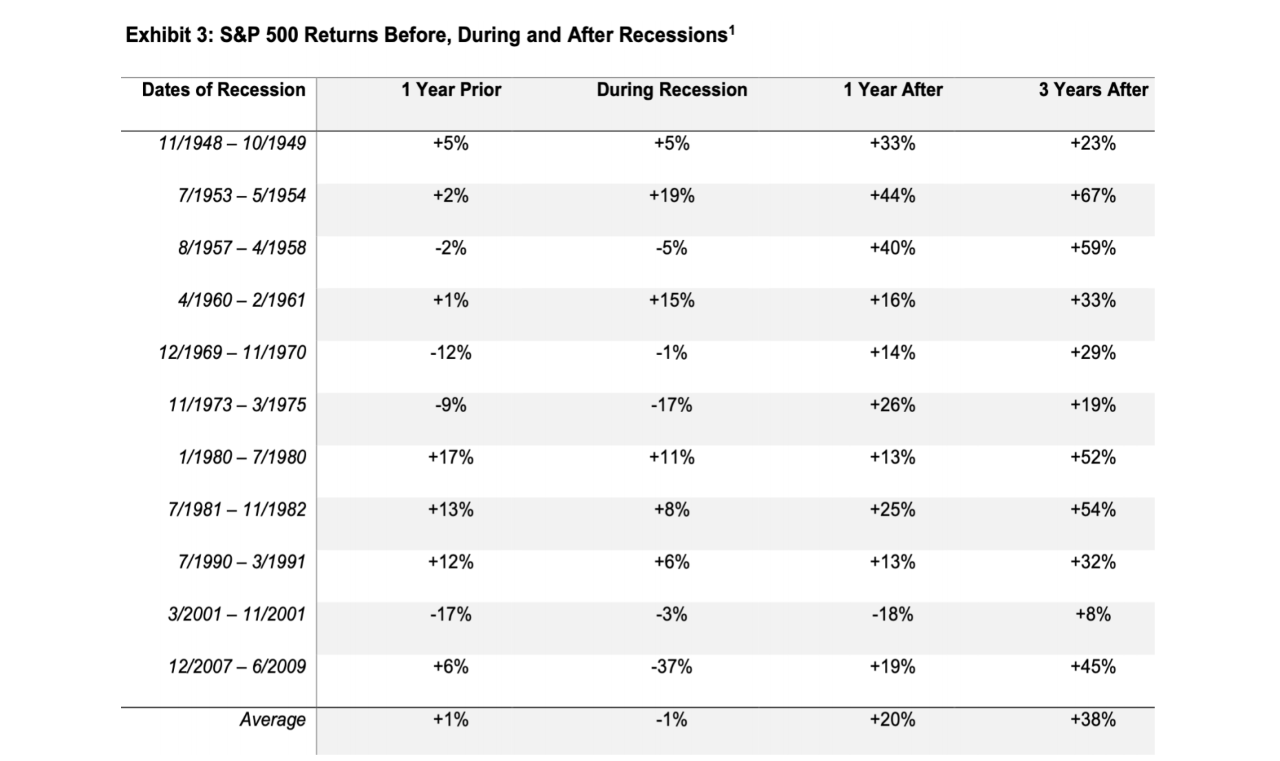

Here are some cold hard facts: No guess work. Using history as a guide. Actual market numbers. History is on our side.

If you follow us on social media (scroll to end of email) Chris will be posting additional thoughts later today.

Tune out the noise and enjoy your summer.

Always in our thoughts and always here if you should wish to speak,

Gregory, Gabriella, Brian, Chris and Samer